Most successful investors have at least one deal that went sideways—fast. For Reilly, that deal happened to be the very first one. It wasn’t just a tough learning experience. It was a full-blown financial disaster… with a price tag of $50,000 (plus interest, mistakes, and emotional damage).

Let’s break it down.

The Setup: “It’s Cheap, So It Must Be a Deal… Right?”

Reilly found a property for $50K. It needed serious work, but the discount was steep—and in his mind, that made it a no-brainer. His logic? Buy low, renovate, profit.

The problem? He didn’t have a clear strategy. No renovation budget, no market comps, no plan for resale. Just a big leap and a lot of confidence.

Mistake #1: Doing It All Himself

Instead of hiring a contractor, Reilly tried to handle the renovation solo. It was his first property, and he thought he could save money by rolling up his sleeves.

Spoiler: He didn’t save money. He lost sleep, time, and any semblance of sanity.

Mistake #2: Listing With the Wrong Agent

When it came time to sell, Reilly chose a brand-new agent with zero experience working with investors. The property sat on the market longer than expected and eventually attracted a buyer—but not the kind you’d want.

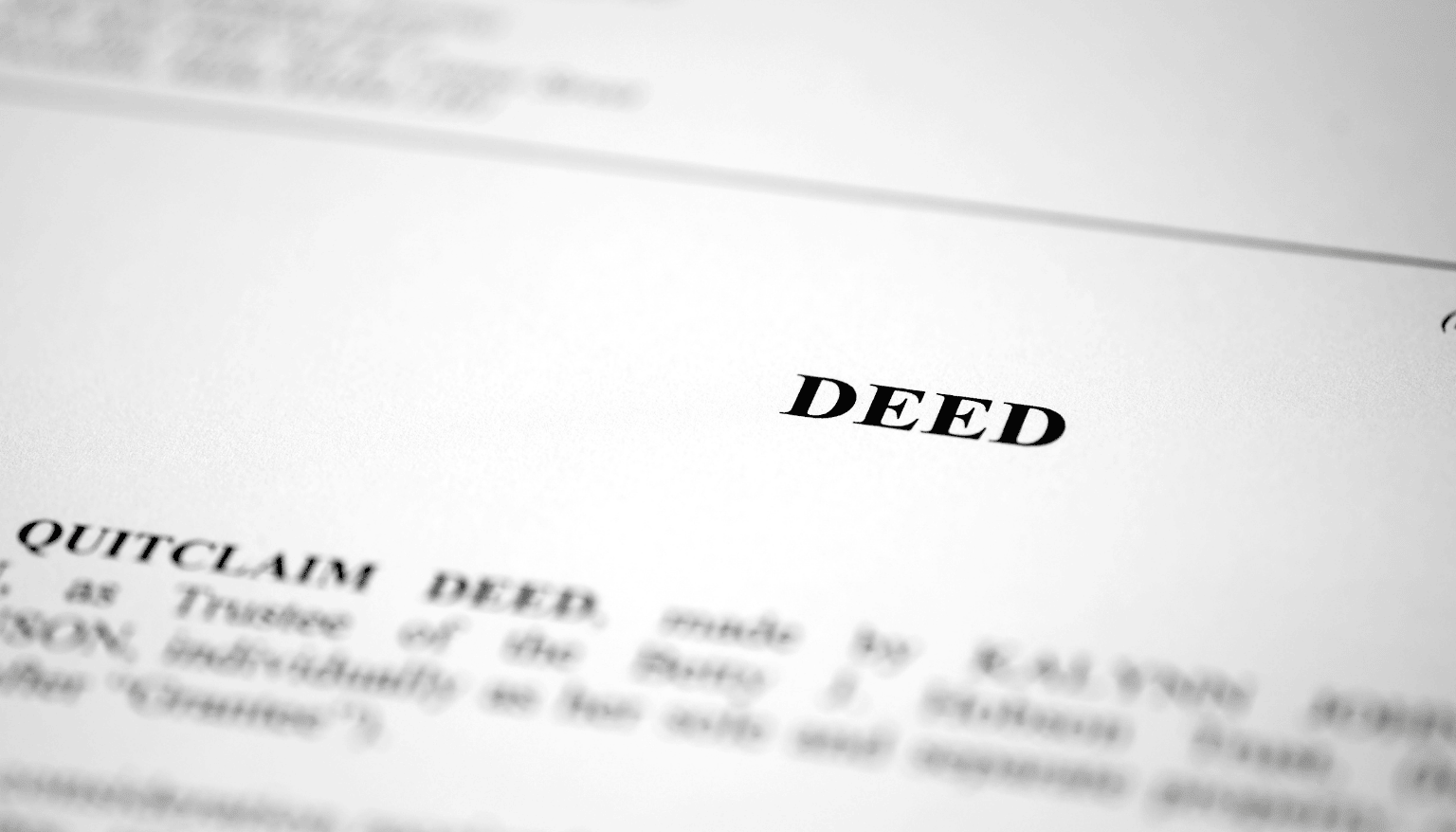

Mistake #3: Selling on a Contract for Deed

Here’s where things really unraveled. Reilly agreed to sell the home on a contract for deed (CFD), skipping critical steps like a credit check or verifying the buyer’s debt service coverage ratio. It wasn’t a structured deal—it was a ticking time bomb.

The buyer defaulted. The house went into foreclosure. Reilly had to initiate a forced eviction, and when he finally got the property back, it was so damaged it required another $40,000 in repairs just to get it back on the market.

The Big Finish: A $1,000 “Profit” and a $13,000 Tax Bill

After three years of stress, repairs, and holding costs, Reilly sold the property. He walked away with $1,000 in profit—but didn’t realize he’d owe $13,000 in capital gains tax on it. The math didn’t just hurt—it haunted him.

The Lesson? Everything.

Reilly doesn’t sugarcoat it: that first deal was brutal. But it was also the best education money could buy. It taught him the importance of:

- Buying with a strategy, not emotion

- Vetting partners and buyers thoroughly

- Avoiding the temptation to “save money” by doing everything himself

- Understanding exit strategies before entering the deal

- And getting help when it comes to taxes

Today, Reilly can laugh about it—but at the time, it felt like a career-ending failure. Instead, it became the foundation for every smart investment decision he’s made since.

“It’s not the best deals that shape you—it’s the ones that nearly break you,” he says.

🎙 Hear more stories like this—and better ones—on Brennan Buzz, where real investors talk real lessons.