Not every charming little inn is a great investment—here’s what to look for before you buy.

There’s something romantic about owning a boutique hotel—handwritten welcome notes, curated coffee stations, maybe a sauna or two. But before you fall for the charm, Reilly Brennan (host of Brennan Buzz and owner of multiple hospitality ventures) has a friendly warning:

“Aesthetic doesn’t pay the mortgage. You need a property that makes sense on paper and in person.”

In this blog, we’re breaking down five non-negotiables every investor should consider when vetting a boutique hotel—based on real experience (and yes, a few mistakes).

📍1. Location Isn’t Just Important—It’s Everything

You can’t renovate your way out of a bad location.

Boutique hotels thrive in places people want to visit—close to trails, lakes, downtown districts, wedding venues, national parks, or seasonal hotspots.

Reilly’s Rule: “If you wouldn’t recommend the area to your own friends for a weekend getaway, don’t buy there.”

✨ 2. That Emotional ‘Wow’ Moment Matters More Than You Think

A boutique hotel isn’t just a bed—it’s an experience.

The best properties have something that makes guests stop and say: “I want to stay here.”

That might be:

- A front porch overlooking Lake Superior

- A restored 1920s fireplace

- A jungle courtyard with hammocks and string lights

It’s not always logical, but listen to your gut. Emotional connection drives bookings, repeat visits, and viral photos.

🛠️ 3. Can You Raise the Value—Without Raising the Risk?

![]()

You’re not just buying the building—you’re buying its potential.

Look for:

- Easy-to-upgrade rooms

- A blank-slate lobby or common area

- Unused outdoor space you can turn into a lounge, sauna, or café patio

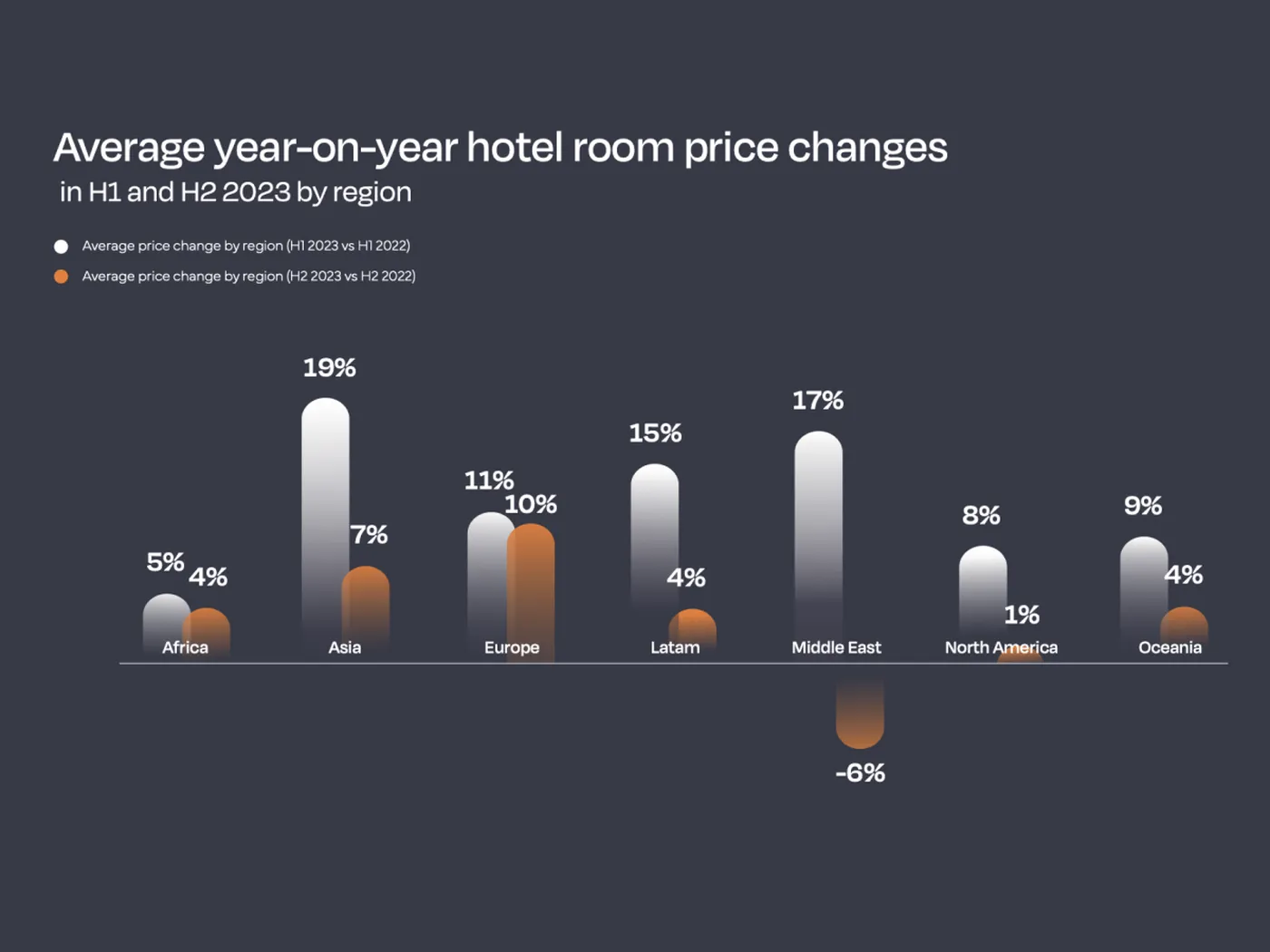

More importantly, run the numbers: Can you increase ADR (Average Daily Rate) after renovations? If so, by how much—and how fast?

Reilly once turned an underpriced bunk room into a group-friendly suite with just paint, a local muralist, and better photos—and doubled the nightly rate.

🕵️ 4. Know the Comps (and Stay in Them)

Don’t just browse Booking.com—go stay in your competition.

Ask:

- What are nearby hotels charging per night?

- Are they using dynamic pricing tools?

- What design elements, amenities, or location perks are making them stand out?

A weekend stay at a similar hotel can give you $20,000 worth of insight—plus some great excuse to “research” in a hot tub.

📅 5. Seasonality Can Make or Break the Deal

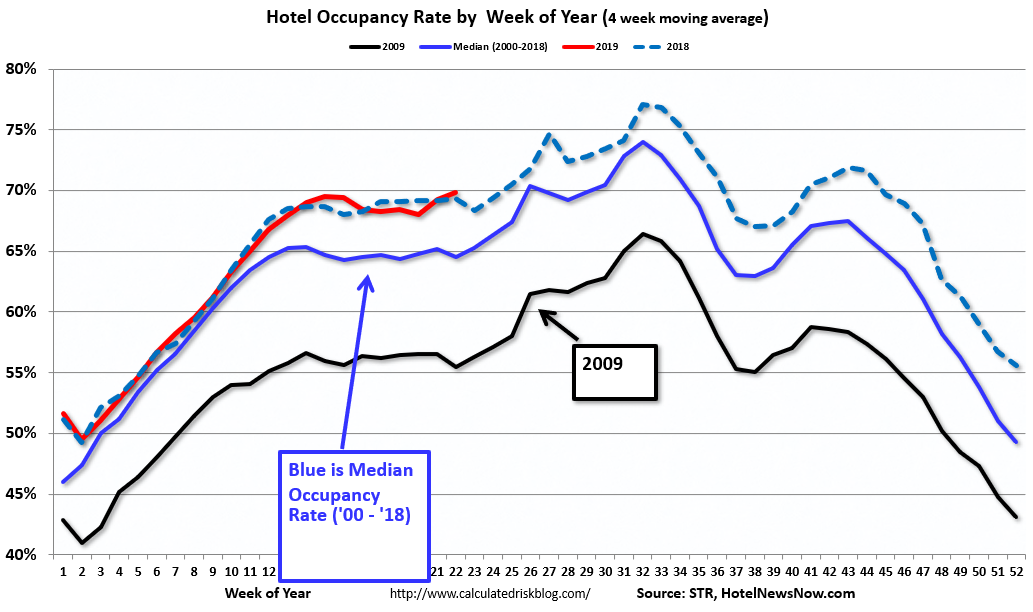

This is the silent killer for many boutique hotel newbies. If your revenue window is 4–5 months a year (looking at you, northern Minnesota), your projected ADR better be really solid—and backed by real booking data.

Reilly’s Quick Math Test:

If you need a full year’s income in half the calendar, it’s not a safe investment—it’s a gamble.

🎧 Want to Buy Smarter, Not Just Prettier?

There’s more to boutique hotel investing than cute robes and quirky keychains. If you want to make real ROI in the hospitality space, focus on location, story, value-add potential, data—and a little bit of gut instinct.

Want to hear more hotel investing strategies from someone who’s done it all (frozen pipes and all)?

Tune in to Brennan Buzz! Subscribe on your favorite podcast platform to stay inspired and connected.